Over the past week, the price of Bitcoin reached a new record maximum, exceeding a mark of 41 thousand dollars. Following him, the biggest drop in the history of cryptocurrency in dollar equivalent: cryptocurrency collapsed to 31.7 thousand dollars. Against these events, traders' activity and trading volumes have seriously increased on large cryptocurrency exchanges, after which Binance, Coinbase and other platforms collided with the next series of failures. ETORO site even decided to temporarily increase the size of the minimum deposit for sales accounts to cope with the influx of beginners. But why are the stock exchanges regularly go offline with sharp drops of Bitcoin's courses?

To begin with, the Explanation: the stock exchanges are really constantly going to offline when panic starts on the cryptocurrency market, and coins begin to jump sharply. That is, traders are tritely can not make a deal or cancel an existing order, which is why problems arise.

Mostly it turns around the lost profits, but the case can also reach the loss - especially if you do not have time to sell the coin on time and go out, for example, in the stelkopin. The latter are attached to the course of dollars and other ordinary currencies, so traders use them to preserve the dollar value of their portfolio and rejection of troubled times. Still, if during this time the course of their cryptocurrency will collapse, the dollar equivalent of funds will be able to preserve. Well, if after this, the trade amateur will still have to be purchased by the same asset at a reduced price, then he also receives double benefits.

Against the background of the regular problems of the Exchange during a sharp change in the situation in the community, even a popular meme appeared in the community. In particular, the coinbase server and other trading platforms are depicted.

However, the problem does not become less because of this, therefore it costs at least to deal with its causes.

Why does not cry cryptocurrency exchange work?

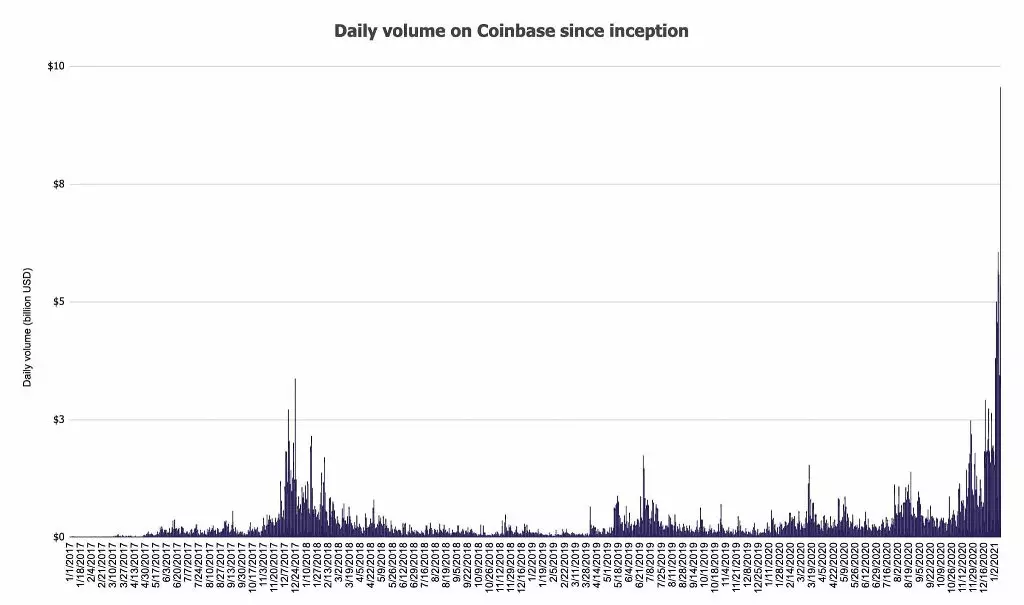

As is known, the times of increased volatility - that is, there are sharp changes in the course - assets can be the most profitable for traders. To buy cheap and sell in such conditions is expensive at least in a matter of minutes. In this regard, in such periods of "mass drop", the exchange of millions of dollars of lost profits is promoted. Analyst The Block Larry Chermak noted that over the past few days, the coinbase has a record splash of user activity. Here is a quote that Decrypt leads.

That is, on the eve of the platform faced with the daily activity of traders, which can be compared with the total load indicators for the quarter. Accordingly, the number of operations carried out was indeed incredible - and the exchange also did not cope with the load.

A sharp traffic splash that creates an additional burden on the stock exchange explicitly caused many basic problems on the technical basis of customer service. But this is not the first Bitcoin rally and not the first sharp increase in the activity of traders. So why is the problem still exist? According to experts, the main problem for cryptocyr is the unpredictability of Bitcoin. CEO of Pocket Network Michael O'Rurrk noted that large companies usually try to find a balance between the current and potential demand for their servers. Here is his quote.

In other words, such problems are inevitable with the growth and adoption of the new industry. For the most expenses "to protect yourself" with additional facilities, it is quite expensive, since more equipment requires large expenses for their service. And if in any other sphere of the company can predict the intended load and attendance of their resources, then cryptocurrency exchanges in this matter are practically powerless. Still cookers change very sharply, and simply impossible to predict such trends.

We believe that the explanation of the problem is quite logical. The additional power of the servers costs weekly, so the leadership of the cryptocurrency exchange is trying to reduce this indicator to the required minimum. However, when a sharp increase happens on the market, it is necessary to have time for the corresponding reaction, which is why problems arise.

Apparently, it will not get rid of the like. Still, the exchanges are now faced with record traffic, which means their costs are also great. I want to believe that over time, this inconvenience will become not so critical for traders. Perhaps some solution to the problem will still be found.

That is why trade in hot periods is often conjugate with interruptions for traders. Take this, if you are still new to the cryptocurrency industry. For other interesting features, read in our cryptoat.

Subscribe to our channel in Telegraph to know everything.