The famous cryptophobe GRAYSCALE INVESTMENTS filed applications for the creation of five more trusts for managing new cryptoactivities, including DEFI assets

GRAYSCALE INVESTMENTS, the largest cryptofund for institutional investors, continues to explore cryptocuse. The company does not want to be limited to such well-known currencies as Bitcoin or Ethereum. As it became known, she plans to create new trusts that will help her to deepen in the decentralized finance segment (DEFI).

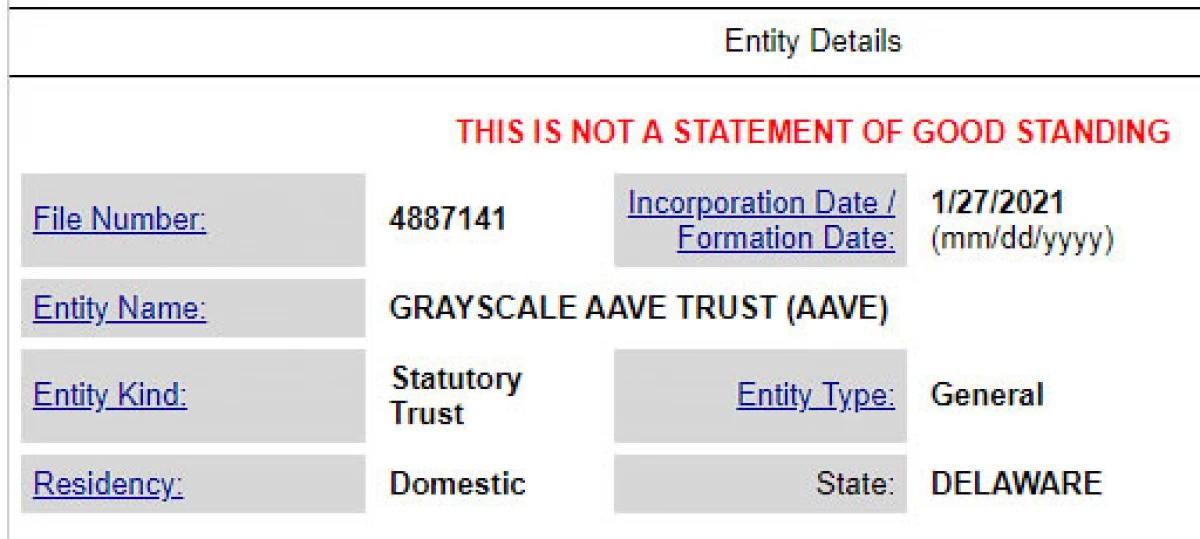

According to information in the corporate register of the state of Delaware, GRAYScale has submitted to the local regulator relevant applications for the registration of five new trusts on digital assets management. Two of them - projects Aave and Polkadot - are directly related to the Defi segment. Applications were registered on January 27th.

By itself, this fact does not mean that GRAYScale will soon launch these trusts in the near future. However, it demonstrates the high interest of the investment giant to the DEFI-industry and his confidence that this industry can bring good profits.

Will GRAYScale plans support the Defi segment? Share your opinion in the comments and join the discussion in our telegram channel!

Defi-trusts come

Three of the five trusts specified in the application - Aave, Polkadot and Cosmos - have something or another to DEFI. So, Aave directly is the second largest DEFI platform for lending. At the moment, the overall size of the assets blocked on it is about $ 3.9 billion, according to DEFI PULSE.Polkadot is a blockchain-project conceived as the "Ethereum killer", built on the principle of creating parallel chains (the so-called paracene) and bridges that ensure the interaction between different blocks. Cosmos is a decentralized ecosystem of independent blocks, designed to create a new generation of the Internet.

The two remaining trust are declared for the confidentiality of Koine Monero and platforms for decentralized applications (Dapps) Cardano.

GRAYScale manages $ 25 billion assets

Recall that GRAYScale has registered trusts for Chainlink (Link), Basic Attention Taken (Bat), Decentraland (Mana), Tezos (XTZ), Filecoin (FIL) and Livepeer. At the same time, the company decided to completely get rid of the XRP-trust because of the trial of Ripple with an exchange regulator

Despite such a variety of interests, in general, GRAYScale cryptoacale is still confidently leading Bitcoin. His share in the total mass of assets under the management of the company is about 80% or $ 20.4 billion. In second place is an Ethereum-trust (15% or $ 3.8 billion). Smaller cryptotransmissions include Litecoin, Bitcoin Cash, Stellar Lumens, Ethereum Classic and Zcash.

According to fresh tweet GRAYScale, currently the total amount of assets under its control is $ 25 billion.

01/28/21 Update: Net Assets Under Management, Holdings Per Share, And Market Price Per Share for Our Investment Products.

- GRAYSCALE (@Grayscale) January 28, 2021

Total Aum: $ 25.0 Billion $ BTC. $ BCH $ ETH $ Etc. $ Zen. $ LTC. $ Xlm. $ Zec.

The company is well known at the crypton in its unrelenting interest in digital assets and constant replenishment of cryptocurrency reserves. Its last purchase was the acquisition of January 2890, 890 Bitcoins, and on January 18, GrayScale made a record largest purchasing BTC in the amount of 16,244 koins.

The POST GRAYSCALE creates new trusts for Defi-Assets appeared first on beincrypto.