After the state indexed the size of the accumulative contribution for the participants of the cumulative and mortgage system (NIS) servicemen, increasing it to

299081.220

rubles, banks began to revise the maximum loan amounts on the program Military Mortgage.

Bank House RFBank House RF increases the maximum amounts of military mortgage. This is due to the growth of the accumulative contribution, which annually index the state.

According to the program "Military Mortgage", the maximum loan amount - 3,432,772 rubles (at a rate of 7.3% per annum). Taking into account the application of the discount 0.2 pp For military personnel receiving wages on the bank's card House. RF, the maximum amount is 3,494,673 rubles.

According to the program "Military preferential mortgage" (+ Gosipotek), the maximum loan amount - 3,905,140 rubles (at a rate of 5.9% per annum). Taking into account the discount 0.2% for salaries - 3,980,748 rubles.

According to the program "Family mortgage for servicemen" the maximum loan amount - 4,306,137 rubles (at a rate of 4.9% per annum). Taking into account the discount 0.2% for salaries - 4,393,690 rubles.

VTBVTB raised the maximum amount of military mortgage to 3,440,000 rubles.

VTB Bank also implements the military mortgage refinancing.

Interest rate - 7.3% per annum.

SberbankIn Sberbank, the maximum amount of mortgage loan in military mortgage increased from 3,141,000 to 3,51,000 rubles.

Interest rate - 7.9% per annum.

The maximum loan period is 25 years.

You can buy an apartment in a new building or on the secondary housing market, or purchase a residential building with Earth or Townhouse.

Let me remind you that such a military mortgage is:The program "Military Mortgage" allows the military personnel to purchase housing almost without attracting their own funds. The state lists each year to personal accounts of the participants of the program of the cumulative and mortgage system of military personnel a certain amount of money - a cumulative fee.

Buy housing serviceman can anywhere in Russia, not necessarily at the place of the current service.

The payment of the initial contribution when buying housing using a mortgage loan and repayment occurs due to this accumulative contribution.

The amount of the sum of the mortgage loan under the program "Military Mortgage" does not depend on the income of the serviceman, and depends on age, driving and the total amount of the accumulative contribution on his personal account.

A military personnel in addition to the usual mortgage loan also "concludes a contract" with the state in the face of Rosvoenipotki. More precisely, he concludes a target housing loan agreement (CZHZ).

To buy housing a larger area, a soldier can use its own accumulation.

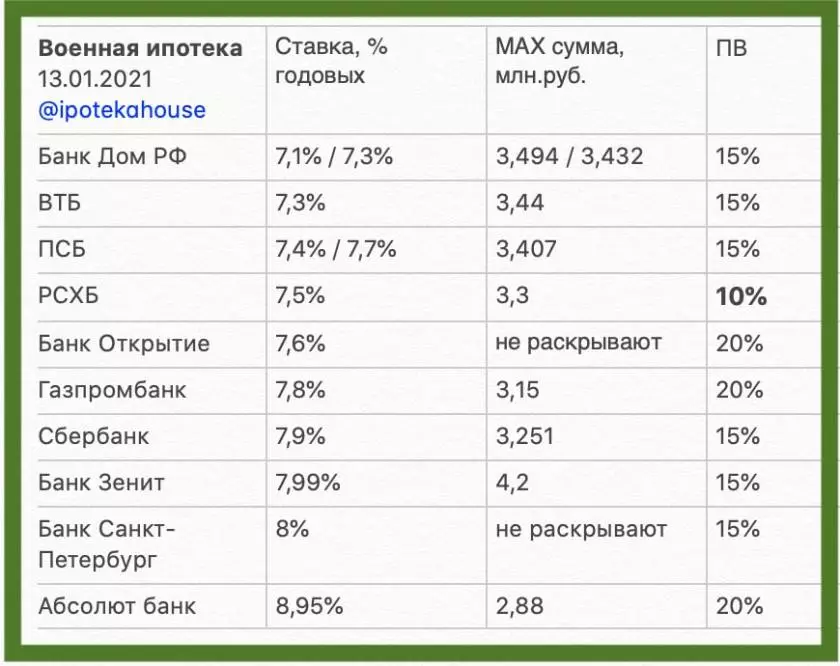

Military mortgage. Buying an apartment in the secondary market (outside the mortgage with state support). Rates and maximum amounts. Update 13.01.2021

Military mortgage. Refinancing is also possible

Military mortgage. Details of the program