A ranar Laraba da yamma, babban yanayin ya kasance matsin lamba akan kamfanonin fasaha na Amurka. A kan wannan asalin, nasdaq sun sami wani 2.7%, ya rage ta 0.4%, da S & P500 ya riƙe matsayinta na tsakiya, yana juyawa da kashi 1.3%.

Ga masu saka jari, yana da mahimmanci cewa wannan ba haɗarin haɗari ba ne, wanda aka lura a cikin kasuwanni daidai shekara ɗaya da suka wuce. An danganta mai sihiri na duniya yana da alaƙa da gaskiyar cewa ribar shaidan da ke ƙasa suka fara gabatar da yawan amfanin ƙasa na kasuwa gaba ɗaya, kuma musamman - kamfanonin fasaha, kuma musamman a cikin apple (Nasdaq: AAPL)), ko ba a samu kwata-kwata (Amazon (NasdaQ: Googl), TSla (NasdaQ: Duk da dogon tarihi da babban Tarihi.

Girma, rinjaye a cikin Nasdaq Index, rasa kyau a kan asalin ci gaba da karuwa cikin riba na dogon lokaci. Yankunan da aka samu na manzo na shekaru 10 ya kai 1.5%, kuma wasu 'yan shekaru 30 - 2.28%, wanda yake kusa da kololuwar makon da ya gabata a cikin 2.35%. Wannan ci gaba ba ya karfafa bambanci tare da rarrabuwa, amma kuma yiwuwar yanayin kasuwanni don kasuwanni.

A lokaci guda, karfafa dala a cikin nau'i-nau'i tare da ChF da JPY-agogo na ci gaba. A lokaci guda, hadarin kula Gbp, Aubi da kuma CAD WANNAN HUKUNCIN SAUKI A CIKIN SAUKI CIKIN SAUKI.

Har yanzu dai har yanzu ana ci gaba da zinare, wanda ya fito a karkashin $ 1700, yayin da mai ya sami damar murmurewa da matakan farkon mako.

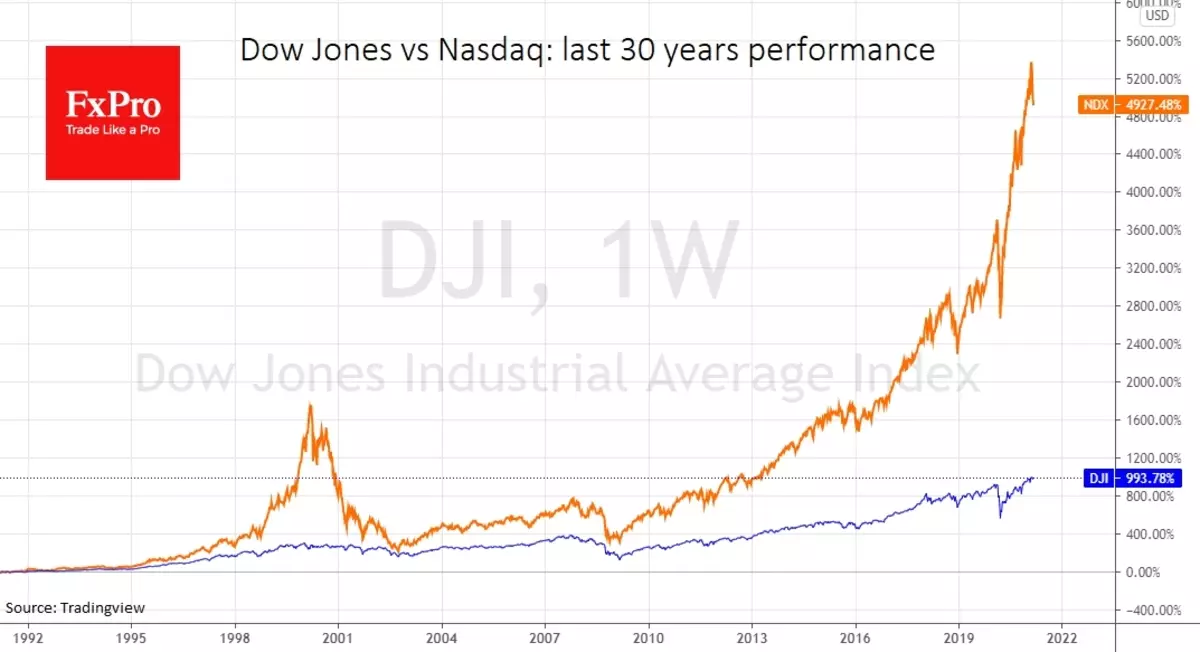

Abu mafi haɗari shine cewa irin wannan rashin raunana kasuwannin jari ba zai ba da izinin Fed don aikatawa, bugu da ƙari mitigantattun manufofi. Conarfafa ci gaba da halin da ake ciki na iya zama wani maimaitawa na tsawon DOT-ComoB a cikin 2000-2002, lokacin da Nasdaq ya rasa 83% na ganiya da 38% a DJ30.

Kasuwancin cigaba da kayayyaki masu tasowa sun zama na farko da za su lalace, tuni a shekara ta 2001, an bai wa ci gaba da girma. Fed ya kiyaye manufar mai taushi, wanda ba wai kawai ya ba da jirgin ruwan hauhawar hauhawar farashin kaya ba, gidaje albarku da kasuwannin kasashen waje, har ma da raunana dala. Duk wannan a cikin wani nau'in da aka fi sani na iya zama gabatarwa na watanni masu zuwa ko ma shekaru.

Team na manazarnan manazarta FXPRO.

Karanta abubuwan asali na asali akan: zuba jari.com