"Na yi imani cewa wadanda suke sayar da hannun jari kuma suna jiran karin lokacin da ya dace don fansar albarkatu iri daya, da wuya cimma burin su. Yawancin lokaci suna tsammanin cewa ragewa zai fi dacewa da shi a zahiri "(c) Fisher Fisher

A cikin wannan labarin, Ina so in watsa rahoton don kwata na 4 na jpmorgan Chas & Co (nyse: JPM), yana kimanta farashin kasuwarta don zuba jari.

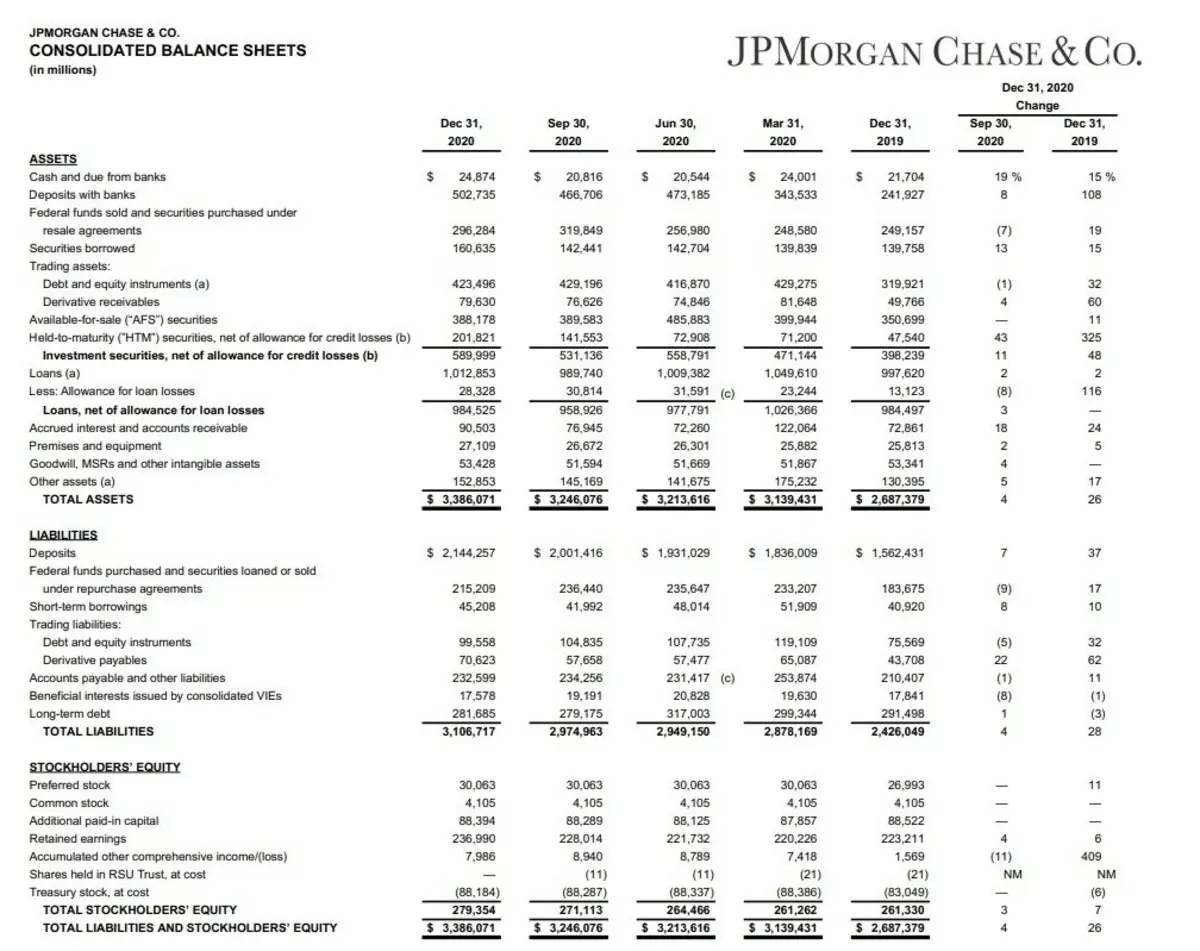

Kasuwancin tsabar kuɗi (tsabar kudi) ya karu da 15% tun Disamba 2019, da kuma kuɗin da aka adana a bankuna (adibas tare da bankuna) ya karu da kashi 10 cikin dari. Don haka, kamfanin a karshen 2020 yana da wadatar kuɗi fiye da dala biliyan 527. Kyakkyawan sakamako.

Saboda wannan, ta hanyar, bashin yanar gizo na kamfanin ya tafi yankin mara kyau. Wato, tare da irin wannan wurin ajiye kamfanin a kowane lokaci na iya biyan bashin ta.

Hakanan, kamfanin ya karu da asara akan rance a kan lamunin, lamunin gidaje (ba da izinin asarar aro).

Babban kadarori na kamfanin ya tashi da 26%.

A cikin layin wajibai (alhaki) zamu iya ganin ci gaban adibas (adibas).

Kamfanin ya lura da ci gaban adibs adon da 37%.

Girma na aro na ɗan gajeren lokaci (karyar ta gajere) zuwa 17%.

Amma bashin dogon lokaci (bashin dogon lokaci) na shekara da kamfanin ya rage da 3%.

Irin waɗannan ayyukan sun haifar da karuwa cikin kyakkyawan kamfanin saboda ci gaban babban birnin da 7% (tootal stock masu riƙe da juna biyu).

Yanzu bari mu kalli rahoton kudin shiga.

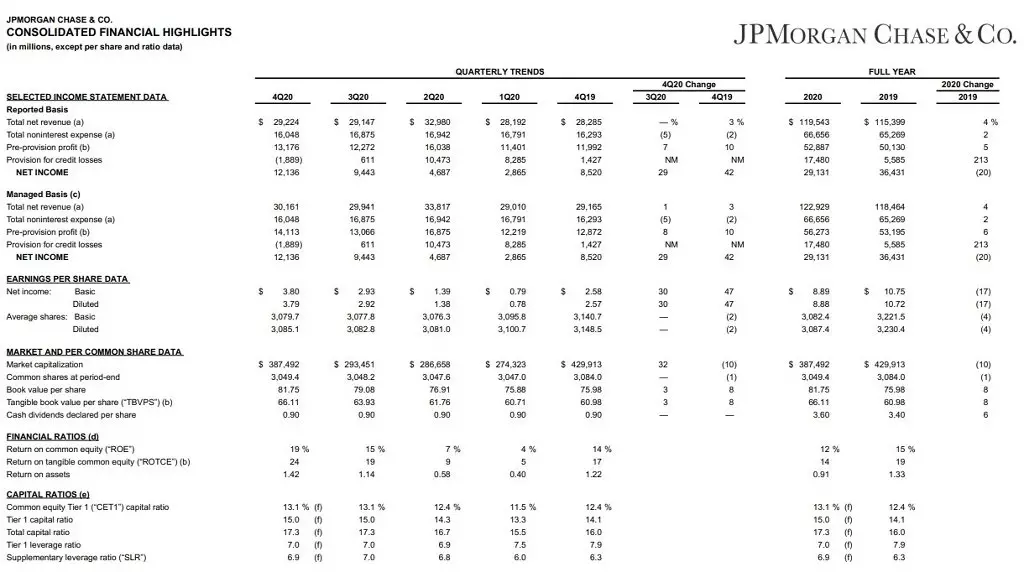

Idan ka kalli babban rahoto (rahoton da aka ruwaito), ana iya ganin cewa kudaden shiga na kamfanin) da kashe kudi (duka (pa (PA: Topfest cushe) Me zai yiwu a ƙara da kudin shiga da ƙara yawan ajiyar abubuwa don asarar (tanadi don asarar kuɗi).

Af, yana saboda ci gaban ajiyar kaya da kuma samun kudin shiga (kudin shiga) ya ragu da 20%. (Ba shakka, ribar kowace rabo ya ragu da riba da kanta.)

A lokaci guda, kamfanin bai ji wani mummunan sakamako a ayyukan aikinta ba. Idan ka bincika wannan rahoto kadan, to, za mu iya ganin irin wannan mai nuna alama a matsayin darajar littafin kowace daraja. Yana fassara kamar "daidaita farashin gabatarwa". Kuma a nan kamfanin ya bayyana cewa littafin darajar raba ɗaya shine $ 81.75.

Kuma ainihin darajar rabo ɗaya a yanzu - $ 135. Har yanzu muna magana game da shi kadan. Wannan mahimmin mai nuna alama ce.

Kuma za mu kalli ganye na gaba.

Yana haifar da sassan.

Har ila yau, rahoto mai mahimmanci ne don fahimtar ayyukan kamfanin.

A zahiri, an raba kasuwanci zuwa sassa 5:

1. Mashahurin banki da kuma Community Banking (Makarantar Kula da Community). Mafi asali. Wannan ya hada da samar da ayyukan banki, sabis na kasuwanci, gudanarwar kadara.

2. Bankin Kasuwanci & saka jari (Kamfanin Kasuwanci & Jairji). Shima babban shugabanci. Ayyukan da aka yi nufin jawo hankalin kudade, magance ayyukan kuɗi da burin kasuwanci.

3. Bankin Kasuwanci (Bankunan kasuwanci). Jagora ya karami, wanda yake nufin rakuna, gidaje, lamuni, da sauransu.

4. kadara & Gudanar Gudanarwa (kadara & Gudanar da dukiya). Yanki da aka yi niyyar sarrafa kadarorin abokan cinikin masu arziki.

5. Corprater. Gaskiya dai, ban san yadda ake fassara shi zuwa Rasha ba. Ainihin, wannan wani sashi ne na hannun jari wanda ya yi nufin neman sabon abokan ciniki da mutane masu sha'awar ci gaban banki.

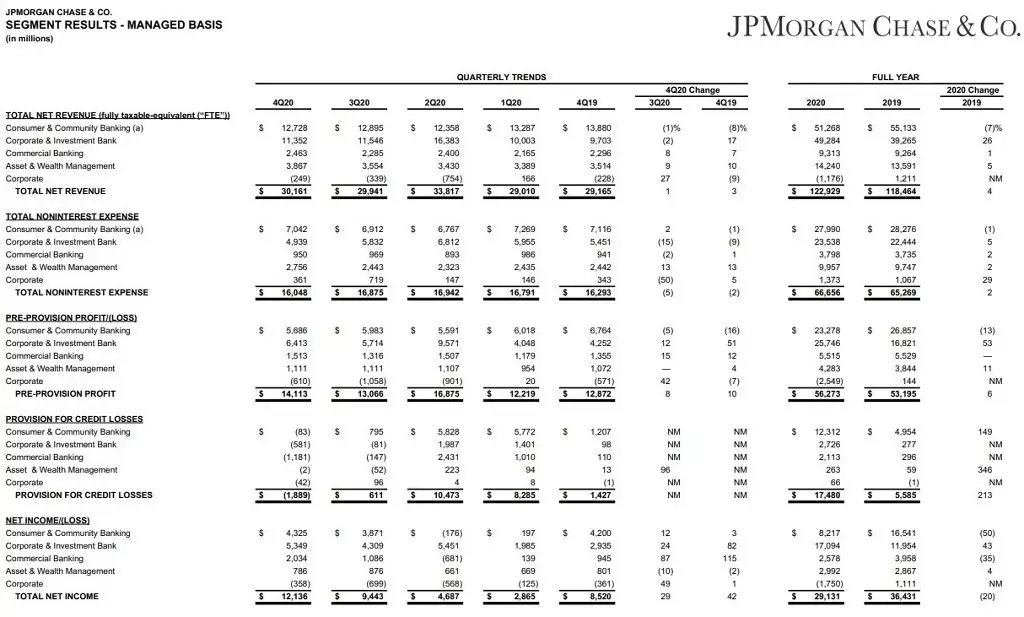

Banki & Community Banking

Wannan sashin ya nuna raguwa a cikin kudaden shiga wannan shekara ta 7%. Mafi yawa saboda raguwa a cikin kudin shiga na awo daga adibas. A bangare ne ya rama da ci gaban jinginar gida. Tasirin wannan an bayar: Rage a cikin mahimmin iko da kuma ci gaban pandemic.

Bankin Kasuwanci & Zuba Jari

Wannan sashin, akasin haka, ya nuna ci gaba saboda karuwa a cikin ayyukan saka hannun jari, wanda Amurka ta samar da matakan tallafi.

Banki kasuwanci.

Ya nuna girma, albeit ƙasa da mahimmanci - 1%.

Samun kudin shiga daga babban aiki ya girma, amma farashin ya karu.

& Kadari

Saminu kuma ya nuna ci gaba da tallafawa daga Amurka Frc da karuwa a ayyukan saka hannun jari.

Me za a iya faɗi game da kamfanin?

Duk da Pandemic, JPM ya kasance babban bankin Amurka, wanda ya ci gaba da gina kadarori. A wannan yanayin, damar da za ta kirkiro da babbar ajiyar kaya ta ba da izinin banki don samun nasarar rawar da ta samu a cikin tattalin arziki.

Kuma ina so in fada wa wannan mai nuna alama daga wannan rahoton a matsayin mai gabatar da babban birnin.

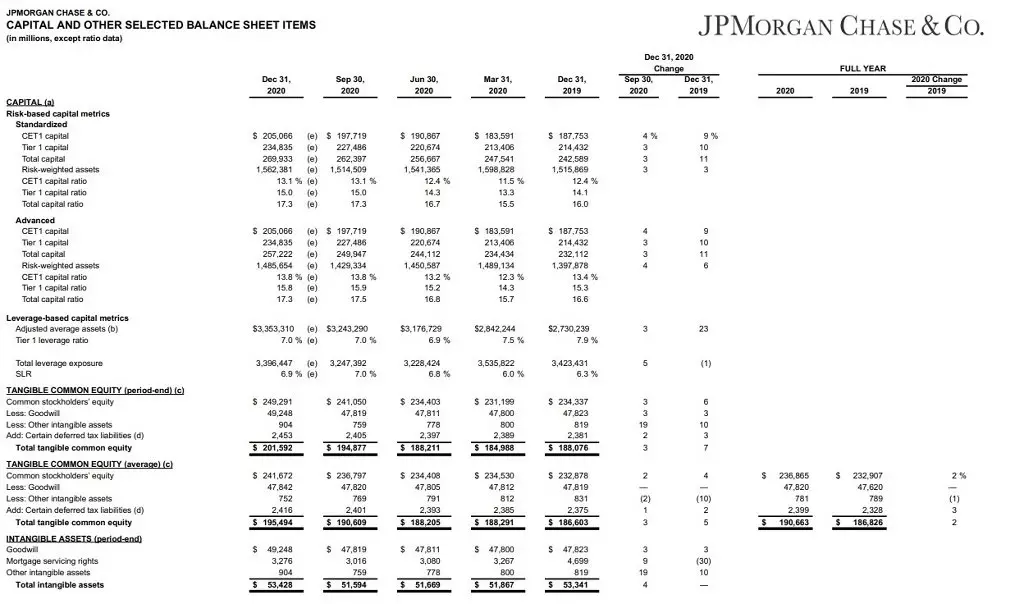

Bayan 2014, an gabatar da ma'aunin babban birnin kasar don bankuna a matsayin matakan riga na tattalin arzikin kasar daga matsalar kudi.

A zahiri, babban birnin birnin shine kashi na ruwa da hannun banki (a cikin tsabar kudi, adibas, hannun jari, da sauransu) zuwa babban birnin kamfanin.

A yayin da ya faru game da rikicin, ana ɗaukar ƙarin babban birnin daga babban birnin matakin farko.

Idan muna maganar kalmomi masu sauƙi - wannan alama ce ta babban babban banki wanda ake amfani da shi don kare masu ajiya.

Mafi karancin abin da ake buƙata don bankuna shine 4.5%.

JPM Wannan mai nuna alama shine 15.5%. Abin da, sake, magana game da babban kwanciyar hankali na banki.

Kuma yanzu bari muyi magana game da farashin kasuwar kamfanin.

Na farko, matsakaicin matsakaicin mai nuna alama p / e - 14.5.

Na riga na bayyana daki daki sosai game da wannan mai nuna alama. Yanzu a takaice zai faɗi kawai cewa wannan mai nuna alama yana sa ya yiwu a fahimci ainihin ci gaba na kamfanin a cikin 'yan shekarun nan.

Kuma wannan mai nuna alama yana da kamfani mai kyau.

Next, tuna, na rubuta a farkon labarin cewa ɗaukar darajar rabon banki ɗaya shine $ 81.75.

Wannan yana nuna mana cewa farashin kasuwa na $ 135 har yanzu ana yawan wuce gona da $ 135. Ko da yake kadan.

P / B mai nuna alama - 1.54.

Tabbas, mai nuna alama L / A ne babban - 91.75%, amma ga sashen banki hakika al'ada ce.

Amma Netdebt / Ebitda mai nuna yana da kyau kwarai da gaske. A wannan lokacin, ya kasance mara kyau ne saboda babban kamfanin, amma kuma kafin pandemic ya kasance 0.86, wanda ke nuna cewa kamfanin zai iya jurewa da nauyin bashi.

Riba

Haske na babban birnin ƙafa 11.15%.

Wannan kyakkyawan mai nuna alama, duk da haka, ya kamata a ɗauka a cikin zuciyar cewa farashin kasuwa ya wuce darajar littafin, kuma wannan yana nuna cewa a gare mu, amma wannan mai nuna zai zama ƙasa - kimanin 7.35%.

Tattara riba a babban matakin - 24.37%. Pandemic ya wuce 30%.

Amma ribar riba akan aikin ya ragu sosai. Jimlar 6.57%. Don wani mai mallaka, wannan mai nuna alama ne, saboda yana nuna ingancin kamfanin game da kudaden da aka kashe. 6.4% kadan.

A kan riba na kadarori, ban ga ma'anar duba ba. Bankin ya kula da dukiyar 3.3 tiriliyan, da ribar dukiyar ta yi rauni sosai, amma ba ta ce komai ba.

Rarraba I.

Sanadiku

Amma a lokaci guda, kamfanin ya biya kyakkyawan rabo a cikin adadin 2.6%. Kuma, yin la'akari da alamun alamun da aka tsoratarwa, wataƙila saboda haɓakar rabo zai ci gaba a nan gaba.

Bari in tunatar da kai cewa Fed saboda cutar pandmam ya hana kamfanonin ƙara girman rabo na lokaci kuma samar da fansar hannun jari. Koyaya, a ƙarshen 2020 ya ba da izinin fansa a ƙarƙashin wasu alamomi, da rabo iri ɗaya suna tsammanin iri ɗaya ne.

Bincike na Comporative

Idan ka kwatanta kamfanin da sauran bankuna "babban hudu" (Bank of America (Nyse: Citigro (Nyse: C), WAFGE: WFC Mafi tsada a tsakaninsu. Haka kuma, ba wai kawai cikin sharuddan capitlasia ba, har ma da masu yawa.

Amma a lokaci guda, JPM ya tabbata a duk faɗin cutar pandemic. Yawan kadarori kuma ya nuna girman aikin aiki. Bugu da kari, JPM tana da ɗayan mafi kyawun masu amfani.

Kayan sarrafawa

Duk da farashin kasuwar kasuwa mai wuce gona da iri, kamfanin ya kasance kyakkyawa don saka jari.

Wannan shi ne babban banki na Amurka, wanda ke tafiyar da kadara fiye da dala 3.3 tiriliyan. Yana da Tarihi mai arziki da kuma yanayin kuɗi mai dorewa.

Na gode da hankalinku!

Karanta abubuwan asali na asali akan: zuba jari.com