Shin ya cancanci siyan FXCN - mafi mashahuri tambayar abokan cinikinmu. FXCN Gidauniyar Index ce, wannan shine, fare a kan kasuwar kasar Sin - saboda haka amsar ba ta da sauƙi.

A cikin labarin yau za mu bincika:

- Dalilin da yasa Sin ta yi musun sauran tattalin arziki;

- Me yasa Yuan ya ci gaba da ƙarfafa dala;

- ME YA SA AKA YI AIKIN SAUKI;

- Me yasa FXCN kyakkyawa ne ga siyayya.

China - gabanin sauran

Tun bayan budewar kasuwancin kasashen waje da saka hannun jari da sake fasalin kasuwar kyauta a cikin 1979, China ta zama daya daga cikin wadataccen samfurin gida (GDP) a matsakaita shine 9.5% zuwa 2018 . Babban bankin duniya wanda ake kira China kasar Sin da ke "saurin girma a cikin manyan tattalin arziki a cikin tarihi."

Irin wannan karuwa ya ba da damar China a matsakaita don ninka GDP kowane shekaru takwas kuma ya taimaka wa mutane kusan miliyan 800 daga talauci. Kasar Sin ta zama babbar matsalar tattalin arziki a duniya (dangane da siyan ikon Power), mai kera, kayayyakin masarufi da mai riƙe kayayyaki.

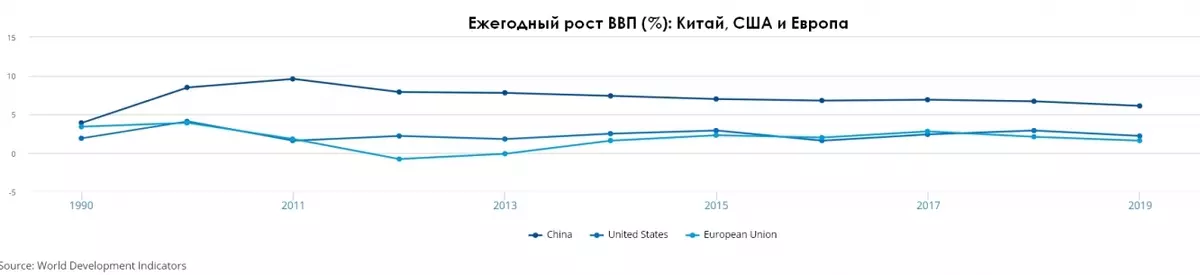

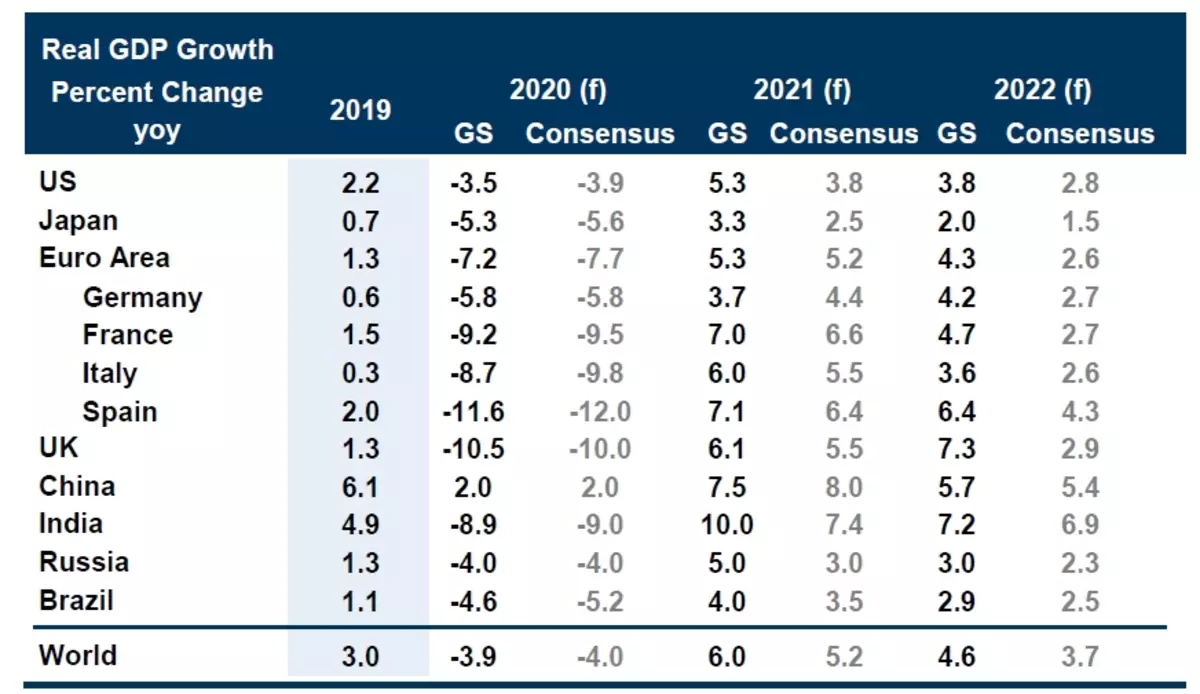

Idan ka kalli bayanan, Sin har yanzu ta girma sau 3 sauri fiye da Amurka da Turai:

Mun ga hakan, duk da ƙungiyar Turai da Amurka, a shekara ta shekara zuwa ci gaban tattalin arzikin Rita yayi saurin sauka. Ana kiran wannan sakamako "tarkon samun kudin shiga." Idan ƙasar tana amfani da direba na girma ɗaya na shekaru, to, nan da jima ko kuma daga baya wannan direban ya samu daga kanta, kuma ana samun ganiyar matakin tattalin arziƙi.

Har zuwa 2015, wannan direban shi ne samfurin masana'anta. Kasar Sin ta ba da matukar hucin mai arha a kasuwar da kuma an bude damar don zuba jari. A sakamakon haka, a China, manyan kamfanoni da aka buɗe samarwa - Apple (NYSE: GM), P & G (NYSE: GM), Coco-Cola ( NYSE: Ko).

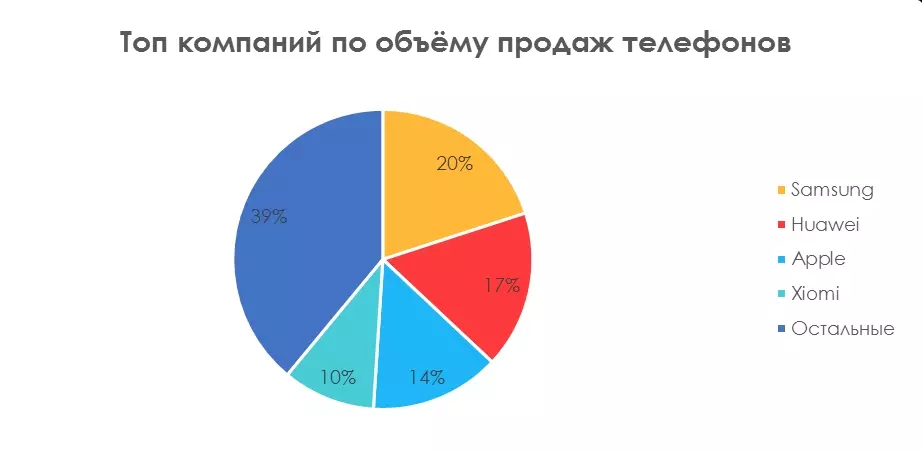

Irin wannan manufar ta baiwa China ta jawo hankalin kamfanoni masu fasaha da samun damar yin amfani da kirkirarsu. Ba asirin ne cewa manyan samfuran samfuran samfuran samfuran saba sun bayyana a China. Wannan yana da kyau kwarai kan misalin masana'antar Smartphone. Guda biyu na manyan kamfanoni na Sinanci ne. Da Huawei har ma sun mamaye Apple ta zamani.

A lokaci guda, irin wannan samfurin na samar da kayayyaki na duniya ya rigaya a bayyana shi tare da kansa, "hukumomin kasar Sin sun karɓi umarnin da ke da fifikon kirkira -" da aka yi a China-2025 ".

Wannan shirin yana nuna canzawa daga samar da kayayyakin kasashen waje don samar da nasa ta hanyar samar da kansa. Kasar Sin ta yanke 'yan jam'iyyar 10 da suka ba da damar kasar ta dauki matsayi mai ƙarfi a cikin juyin juya halin masana'antu ta hudu ". 5 Daga cikin su yanzu suna cikin sassan da suka fi girma da yawa:

1. Intelle mai hankali

2. Abubuwa na Intanet

3. Rarrabawa

4. Ilimin injin

5. Green makamashi, gami da waƙoƙi.

China da COVID-19

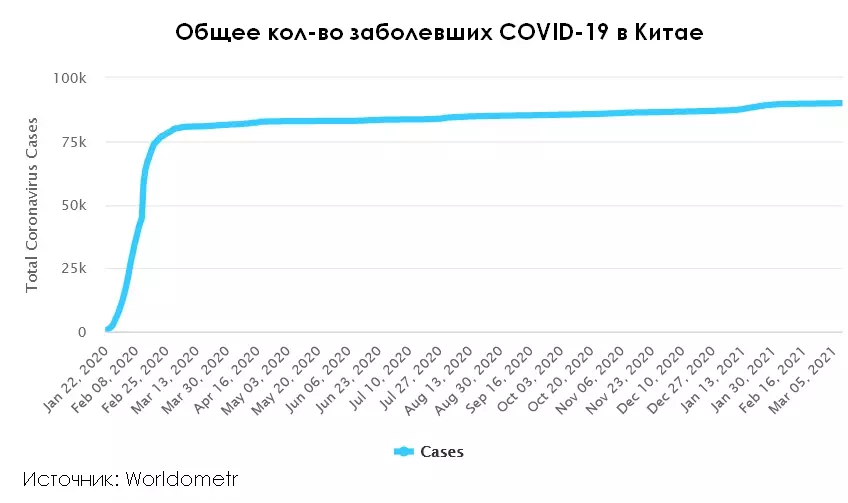

A farkon 2020, CoviD-19 da sakamakon tattalin arzikinta an dauke shi ne yayin da matsalolin da suka shafi kasar Sin ne kawai. Yanzu China ta zama daya daga cikin kasashean kasashe da suka samu nasarar tsara yaduwar kwayar, da kuma tattalin arzikin da ya nuna ci gaban GDP da karshen 2020. Yawan coronavirus na cututtukan fata a kasar Sin kusan bai yi girma ba:

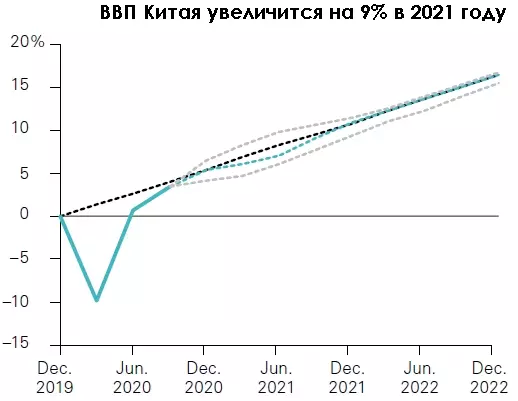

Vugard a cikin yanayin asalin na tsammanin ci gaban GDP na kasar Sin a shekarar 2021 a matakin 9%:

Tare da wannan ra'ayin an yarda da kuma Sasara na Goldman Sachs. GS ta annabta ainihin ci gaban tattalin arzikin China kawai a kasa da yarjejeniya da kashi 7.5, amma kuma a cikin sigar kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin ne - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin ne - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin ne - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin - tattalin arzikin kasar Sin

Don kwatantawa, a cikin binciken da aka bincika na Fed, masu hujjojin ƙwararru suna jiran haɓakar GDP a kashi 4.5% a cikin 20%, wanda har yanzu yana da ƙasa da girma na GDP na GDP.

Jimlar tattalin arzikin China shine mafi yawan alƙawari a shekaru masu zuwa.

Kasar Sin ke nuna kumfa a kasuwar hannun jari

Shugaban Babban Bankin ya ce, kasar Sin za ta biya kwallaye fifikon kwanciyar hankali a cikin 2021, da kowane matakai don dakatar da matakan da za su iya tasiri kan tattalin arzikin.

Bankin jama'a na kasar Sin na bunkasa (dala biliyan 12) na tsarkakakkiyar ruwa ta hanyar budewar kasuwa - aikin da tsarin banki ya ba da junan mu.

Babban bankin Sin yana kokarin hana ci gaban kasuwa. Magana CSI na kasar Sin 300 sun cimma matsara mafi girma tun daga rikicin tattalin arzikin duniya na 2008 na duniya. Wannan ya faru ne saboda karfi da masu saukin azurfa na masu neman masu saka jari daga sakamakon coronavirus. Gabaɗaya, daga Maris 2020, a cewar lokutan kuɗi, dala biliyan 150, wanda ya haifar da yanayin ƙasa mai ƙarfi, wanda ya ci gaba da hauhawar farashin kaya a ƙaramin matsayi. A sakamakon haka, kuɗi ya zo ba kawai a hannun jari ba, har ma shaidu:

Godiya ga wannan, index na kasar Sin ya girma da kashi 10% tun farkon shekara, amma bayan gudanar da ruwa mai ruwa ya ragu daga maxima ta fiye da 15%. A lokaci guda, nasdaq 100 index ya ragu da kashi 7% daga matsakaicin matakin saboda karuwar yawan fursunoni 10:

Koyaya, yana da mahimmanci a fahimci cewa ragi a cikin jigon kasar Sin yana da alaƙa da ayyukan da aka yi niyya na mai gudanar da Sinanci. Babban bankin kawai zai dawo zuwa ga yanayin kudi na "al'ada" bayan rauninsu a cikin 2020 sakamakon covid-19. Wato, wannan shine lokacin da aka saƙa lokaci-lokaci saboda "daidaituwa" na ƙa'idodin wasan. Ci gaba da ci gaban kasuwa zai koma bayan tattalin arzikin China.

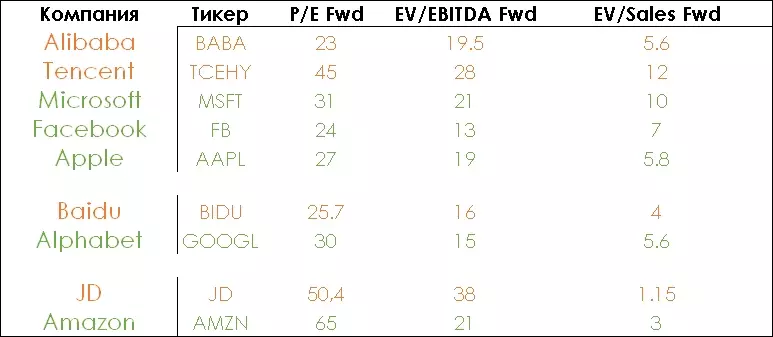

A sakamakon haka, yanzu muna samun kyakkyawar shiga wurin shiga kamfanonin kasar Sin, saboda suna da aramogs masu rahusa a cikin Amurka:

Kadai wanda ya ƙwanƙwasa waje ya kasance.

Jimlar: Chips Chips Cheick Cheaper ne fiye da Analogs na Amurka.

Yuan zai karfafa dala

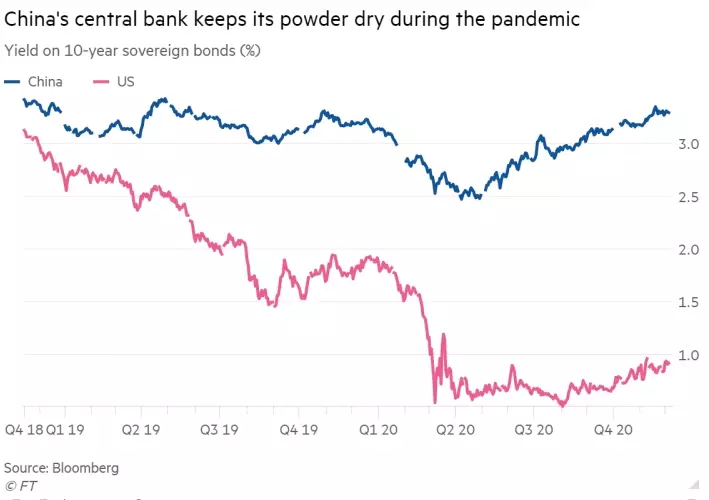

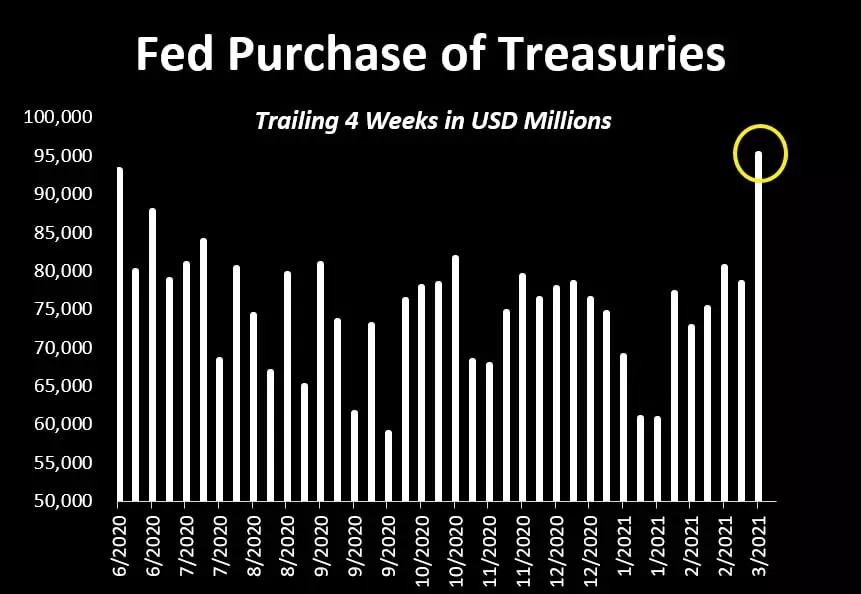

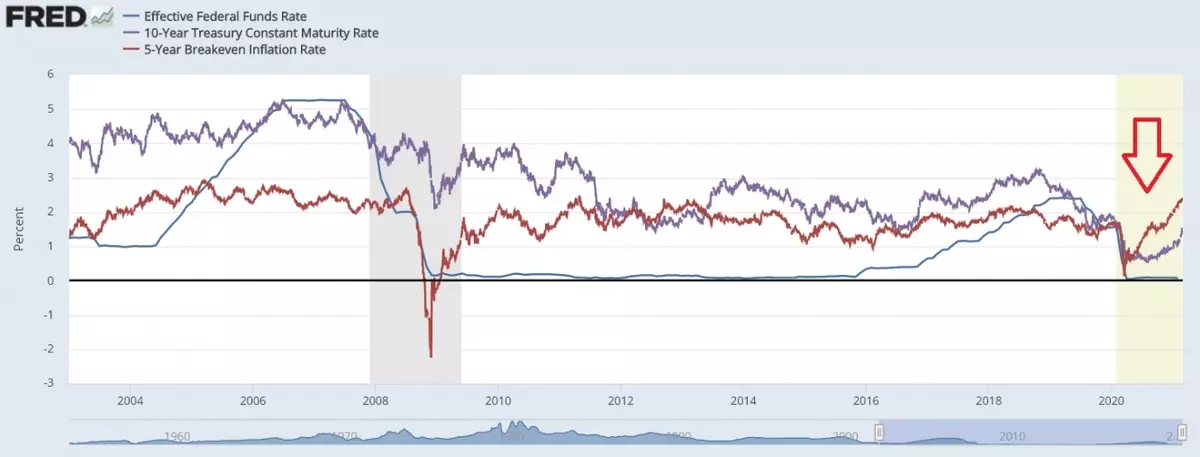

The ciyar da Amurka na ci gaba da gudanar da manufofin kuɗi mai taushi kuma yana ƙoƙarin ci gaba da ƙaruwa cikin ribar biliyan 10:

Idan a takaice, to, a cikin kuɗin kuɗi na shaidar Amurka masu haɗari ne kuma tushe don lissafa ƙwarewar wasu kadarori, gami da hannun jari. Hannun jari sun fi yawan haɗari fiye da shaidu, sabili da haka, idan yawan amfanin ƙasa na ɗaukakawa yana haɓaka, ya kamata kuma girma da yawan amfanin ƙasa don rabon hannun jari. Mai amfani "riba" wanda yake wakilta ne ta hanyar hannun jari na e / P, tunda E zai iya samun riba ga watanni 12 da suka gabata, P na iya canza darajar aikin. Ci gaban da ake buƙata na samar da amfanin E / P daidai da raguwar P / E - Wato, sake dawo da hannun jari.

A sakamakon haka, Fed yana ƙoƙarin guje wa faɗuwa mai kaifi a cikin kasuwar hannun jari, buga kuɗi da kuma siyan shaidu. Yana da mahimmanci a fahimci cewa hauhawar farashinsa yana da alaƙa da buga kuɗi na kuɗi da rarraba yawansu. A lokaci guda, yawan amfanin ƙasa da yawan adadin shekaru 10 yana haɓaka saboda haɓakar hauhawar farashin kaya:

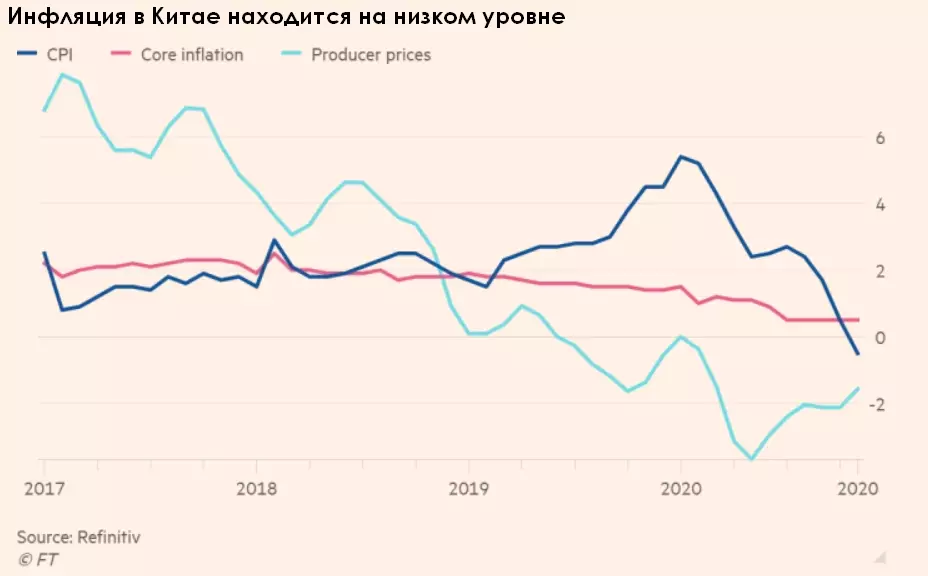

A China, irin wannan matsalar ba a kiyaye. China, akasin haka, yana rage ruwa a kasuwa, da hauhawar farashin kaya:

Babban hauhawar farashin kaya a cikin Amurka a tara tare da bugawar kuɗi da tsaka-tsaki a kasar Sin za su zo don ƙarfafa yuan a dala. A sakamakon haka, farashin waɗannan kamfanonin zasuyi girma a cikin dala daidai, wanda yake da kyan zuba jari.

Jimlar: Yuan zai ci gaba da ƙarfafa dala.

Wanene aka haɗa cikin FXCN?

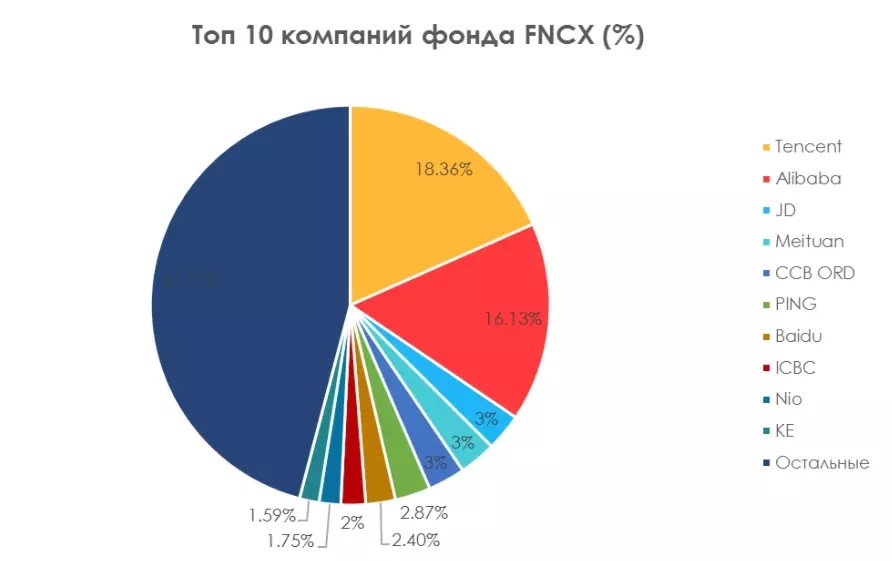

Chinx MSCI China UCCIs ETF USD rabawa a cikin aji (MCX: FXCN) wani asusu ne daga mai samar da Kamfanonin Lalkiyoyin kasar Sin. Gabaɗaya, asusun na kamfanonin 210, da kuma babban nauyi shine sassan uku: kayan yau da kullun buƙatun, Telecom da kudi. Hukumar kafar ita ce 0.9% a shekara.

Akwai kamfanoni biyu a cikin Asusun, tara tara kashi 34% na Index - Harshen da alibaba:

Tocent.

(OTC: TCELY) yana daya daga cikin mafi girman kamfanoni. Desent Mannes babban adadin ayyuka daban-daban: Wasannin wayar hannu, Manzanni, Kiɗa, Shagunan Yanar gizo, shagunan imel. A cikin duniya, Sence sanannu ne a kashe wechat - manzon manzo na kasar Sin da wasanni na baya - tallafi ne wanda ya kirkiro cewa Legends. Ana samun hannun jari akan musayar SPB kawai ta hanyar ƙwararrun masu saka jari.

Alibaba.

(Nyse: Baba) -

Hakanan daya daga cikin manyan kamfanonin fasaha a cikin duniya. Alibaba yana shiga cikin e-commerce (TABOOO, ALIEXPress), Kamfanin girgije (Alifaba Uwargida (Alipay conluting) kuma ya mallaki da kamfanonin intanet da kamfanonin intanet da kamfanonin intanet.

Alibaba da kuma kyautuka sune manyan 'yan wasan China biyu. Suna cikin rayuka cikin sha a cikin ƙananan ƙananan 'yan wasa kuma ta yadda ta ƙara fayil ɗin su na dabarun sa dabaru. Dukkanin kamfanoni a China ba su da irin wannan ƙarfin, saboda haka waɗannan 'yan wasan biyu suna keys ne ke falls ne a China.

JD.com.

(Nasdaq: JD) yana ɗaya daga cikin kasuwancin kamfanoni daga sashen e-commerce.

Meaith.

-Diumppping.

—

Kamfanin ya kafa ta METAUAN (OTC: MPNGF) (isar da kaya daga Intanet) da kuma dianping (gidajen abinci da sauran agograGyator). Kamfanin kamfanin ya yi ciniki ne kawai a cikin musayar hannun jari na Hong Kong.

Bankin gine-gine na kasar Sin.

(OTC: Cichy) - daya daga cikin manyan bankuna a kasar Sin da duniya, tun daga shekarar 2015 sun haɗa a cikin jerin manyan bankunan duniya. Akwai kawai ta hanyar ƙwararrun masu saka jari.

Ping inshora.

(OTC: Pngay) shine mafi girma inshora a duniya. Baya ga inshora, rike yana cikin gudanar da kadara da sabis na banki. Akwai kawai ta hanyar ƙwararrun masu saka jari.

Baidu.

(Nasdaq: BIDU) - Yana da wanda ya mallaki injin bincike a China, a cikin binciken duniya na duniya. Kashi 98% na kudaden shiga kamfanin ya fadi a kasar Sin.

ICBC.

(HK: 1398) - Bankin kasuwanci na kasuwanci na kasar Sin, an haɗa shi a cikin manyan bankunan China na manyan bankunan China. An gudanar da aikin a Shanghai da musayar jari na Hong Kong Kong.

Nio.

(Nyse: Nio) - Mai kera kasar Sin. Hakanan ana aiwatar da shi a bauta wa motocin su kuma suna sayar da tashoshin recations na lantarki don motocin lantarki. Akwai kawai ta hanyar ƙwararrun masu saka jari.

Ke riƙe.

(Nyse: Beke) - sabis na kan layi da kuma layi-layi sabis don kasuwar ƙasa. Ana samun hannun jari akan musayar jari na New York.

A sakamakon haka, mai saka jari na Rasha wanda ba shi da cancantar zai iya siyan hannun jari 3 daga sama-10: alibaba, JD da Baidu. Babu wani abin da yake cikin wannan jerin - daya daga cikin manyan 'yan wasan kasar Sin, har ma' yan wasa uku ba za su bayar da yumunci ba.

FXCN ita ce hanya mafi kyau don samun kuɗi a China

A sakamakon haka, muna da ma'amala uku da za mu sa kamfanonin kasar Sin:

1. Matsakaicin mafi sauri a cikin 2021.

2. karfafa yuan zuwa dala.

3. Rashin damuwa game da irin kamfanoni a Amurka.

Amma akwai kuma microprusishes da yawa a cikin ni'imar son FXCN:

1. Yawancin kamfanonin kasar Sin ba su samuwa ga masu saka hannun jari.

2. Asusun yana ba da rarrabuwa ga kamfanoni 210.

FXCN kayan aiki ne mai dacewa don yawancin masu saka hannun jari na Rasha, kamar, a gefe guda, ya ba ku damar yin fare a cikin rubles, wanda ke kare shi daga rauni na da goge shi ga dala.

An rubuta labarin ne tare da hadin gwiwar manajan Ditry Newbikov

Karanta abubuwan asali na asali akan: zuba jari.com