In particular, exports amounted to $ 3.2 billion (-29%), imports - $ 2.4 billion (-4%), reports inbusiness.kz with reference to AFK.KZ.

CURRENCY MARKET

In the foreign exchange market KASE on Friday, the USDKZT pair demonstrated downward dynamics against the background of moderately positive signals from foreign markets. According to the results of the trading rate, the USDKZT pair closed at 418.68 tenge per dollar (-0.44 tenge) at a high volume of bidding at $ 140.5 million (+44.7 million). Obviously, in the short term, the change under the specified currency pair can continue to be low at the corresponding signals from foreign markets. Recall that the Finnish experts expect a pair of USDKZT by early April at the level of 418.6 tenge per dollar.

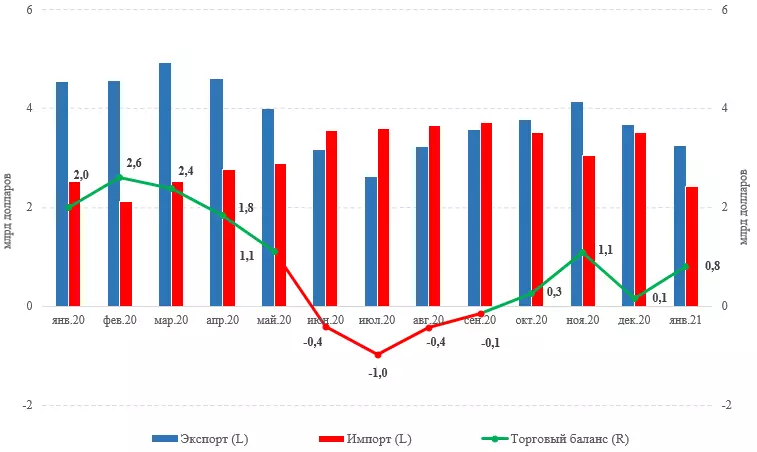

From published statistics, we note that according to the preliminary data of the Agency for Strategic Planning and Reforms in January 2021. The foreign trade turnover of the Republic of Kazakhstan amounted to 5.7 billion dollars and compared with the same period 2020 decreased by 20%, including exports - $ 3.2 billion (-29%), imports - $ 2.4 billion (-4%) . Thus, the trade balance surplus at the end of the reporting period amounted to 0.8 billion dollars, against 2.0 billion in January 2020 (decreased by 2.5 times).

Recall that from February T.G. As part of the OPEC transaction + the country increased oil production (+10 thousand b / c), which together with a significant increase in prices in the hydrocarbon market will contribute to the further improvement of the trade balance in other other conditions.

Chart 1. Trade Balance of the Republic of Kazakhstan, 2020-2021:

Source: BNS Aspir RK

MONEY MARKET

Trading volumes in the money market were also elevated. The total bidding volume of one-day instruments amounted to 472.0 billion tenge, while the average daily volume since the beginning of the year is 401.0 billion tenge. At the same time, the weighted average cost of attracting tenge liquidity under the US dollar for one day increased to a level of 8.80% per annum (+16 bp), while the weighted average rate on Overnight reamp operations was recorded at 9.18% per annum. (-27 bp).

STOCK MARKET

On Friday, the KASE index has practically not changed, closing at the mark of 2963.03 points (+ 0.07%). As part of the index, the decline in the prices of Kaz Minerals shares (-2.1%) and "Kcell" (-0.9%) was balanced by the increase in the value of KazTransOle's equity securities (+ 1.5%) and "Kazakhtelecom" (+1, one%). Meanwhile, the People's Bank published financial statements in 2020 - net profit increased to 352.7 billion tenge in comparison with the indicator of 334.5 a year earlier (+ 5.4%). Shares of the Financial Institute on Friday rose by 0.5%.

WORLD MARKET

The key stock indices of the United States showed predominantly positive dynamics (in the range of 0.1-0.9%) against the background of strong macrostatistics. The consumer sentiment index of the University of Michigan, reflecting the degree of household confidence in the US economy, grew up to 83.0 points from February 76.8 points. At the same time, analysts expected an indicator of up to 78.5 points. Meanwhile, a certain pressure on the market was rendered by another surge of the yield of US governmentobalities (US10YT increased to 1.63% C 1.54 earlier) against the background of expectations of accelerating inflation and restoration of economic growth in the light of the adoption of the next package of US economy, accelerating vaccination in the country. The market fears that a sharp strengthening of inflation will encourage the Fedrev to tighten the monetary policy. Accordingly, the Martam meeting of the US Fedreva This week (16-17.03) may bring clarity towards monetary policy in the medium term.

OIL

Oil quotes continue to fluctuate near a record level of $ 70 per barrel (-0.6% on Friday). The market support expects to quickly restore demand for raw materials against the background of the continuing reduction in the number of cases of COVID-19 diseases in the world. Meanwhile, according to WSJ, Israel, since the end of 2019, at least a dozen Iran tankers, delivered oil and weapons in Syria, was attacked, which led to the delay in the supply of raw materials.

RUSSIAN RUBLE

The Russian ruble on Friday slightly decreased against the US dollar as part of the correction. According to the results of currency trading, the USDRUB pair closed at 73.3 rubles per dollar (+ 0.04%). Analysts note that the pressure on the ruble had a decrease in oil quotes. At the same time, the support of the Russian currency can be provided with the start of the March Fiscal period (15.03), as well as a meeting of the Bank of Russia at the key rate (19.03).