The Walt Disney Company (NYSE: DIS) is a company that is hardly needed. I will only say that (among other things) in this media component of Marvel, Lucasfilm, Pixar, 20th Century, National Geographic, Disney + Stregnation Service, 6 Disneyland Parks, and, of course, The Walt Disney Studios. Promotations of shares at the time of writing Articles: $ 183.60. Current capitalization: $ 333 billion. The report came out on February 11, 2021

History

In the summer of 1923, the Walt brothers and Roy Disney came to California with an 8-minute cartoon with the combination of live actors "Country of Wonders Alice", which was able to sell a distributor. On October 16, 1923, a contract was signed on a series of cartoons about Alice. From this date, Disney Brothers Cartoon Studio begins.Four years later, Walt Disney came up with Oswald's rabbit, creating 26 cartoons, but the distributor took advantage of the terms of the contract and, having exceptional rights to this character, carried out realization without a disney. After the annoying loss of Oswald, Walt Disney came up with Mickey Mouse, but the first two films no one wanted to buy, because they were dumb. By configuring your mistake, the 3rd cartoon about Mickey Maus, already with synchronous sound, was released on the screens on November 18, 1928. And he had stupid success.

From 1932 to 1943 Disney cartoons won 10 Oscar premiums (from 11 ceremonies held). For his life, Walt Disney received 26 Award awards (what is a record for one person to this day), the last of which was awarded in 1969 posthumously. On December 21, 1937, the Cartoon "Snow White and Seven Dwarfs" was released, which received 8 Oscar awards and held the title of the Cash Cartoon (taking into account inflation) until 1993, the record was beaten by Aladdin (Production of Disney), and then King Lvom (also the production of disney).

In 1940, at that time, the already called Walt Disney Productions spent an IPO. On July 17, 1955, the world's first Theme Park Disneyland in California opened. In 1964, the film "Mary Poppins", who was awarded 5 Oscar awards and fell in 2013 to the National US film register (in the registry of only 800 films). Your current name "The Walt Disney Company" Company acquired in 1986

Disney has constantly developed by realizing itself in new directions and every time achieving stunning success, which has allowed the company to take a leading position in the entertainment industry.

Dividends

Disney began paying dividends over 60 years ago, but only in 1986 he tried to take a rule an annual increase in dividends. Until 1999, the company paid dividends quarterly, but then decided to go to the annual payment, explaining this with high false expenses (sometimes small shareholders had to pay dividends less than the company spent on post sending checks). Since 2015, the company has become paid dividends every six months. In 2020, the company under the influence of the crisis completely canceled dividends.

The company never reduced dividend payments (the discrepancies of the years took place when changing the frequency of payments). Since 2005, the percentage of net profit payments rarely exceeded 25%, and the dividend yield is 1.5%. For the Disney Guide, Dividend's payment has always been with the lower priority in relation to investments in business development. In the near future, Disney does not plan to resume dividends. But I think, even when payments are resumed, the investors should not focus on dividends, because the yield will be completely unattractive.

Changing the value of shares

Disney walks enough. It advantageously borrowing, for the period up to 6 years it is possible to profit 300%, but at the same time it is also rapidly flourished by 30-50%.

Today, Disney is 20% more expensive than a year ago, while the company managed to survive and fall by 50%, and take off at 145%. It is difficult to deny that since 2009, the shares have a trend on raising (although, even since 2002), but by purchasing at the peak in 2015, the investor would have to reinstate a drawdown to 30% for 4 years. Beta volatility for 5 years is 1.20, i.e., the company's shares are 20% wider than the market as a whole. Thus, the company with interest compensates low dividends due to a good movement of the value of shares. But Disney is already difficult to calculate the shares of the type "bought and forget."

Financial indicators

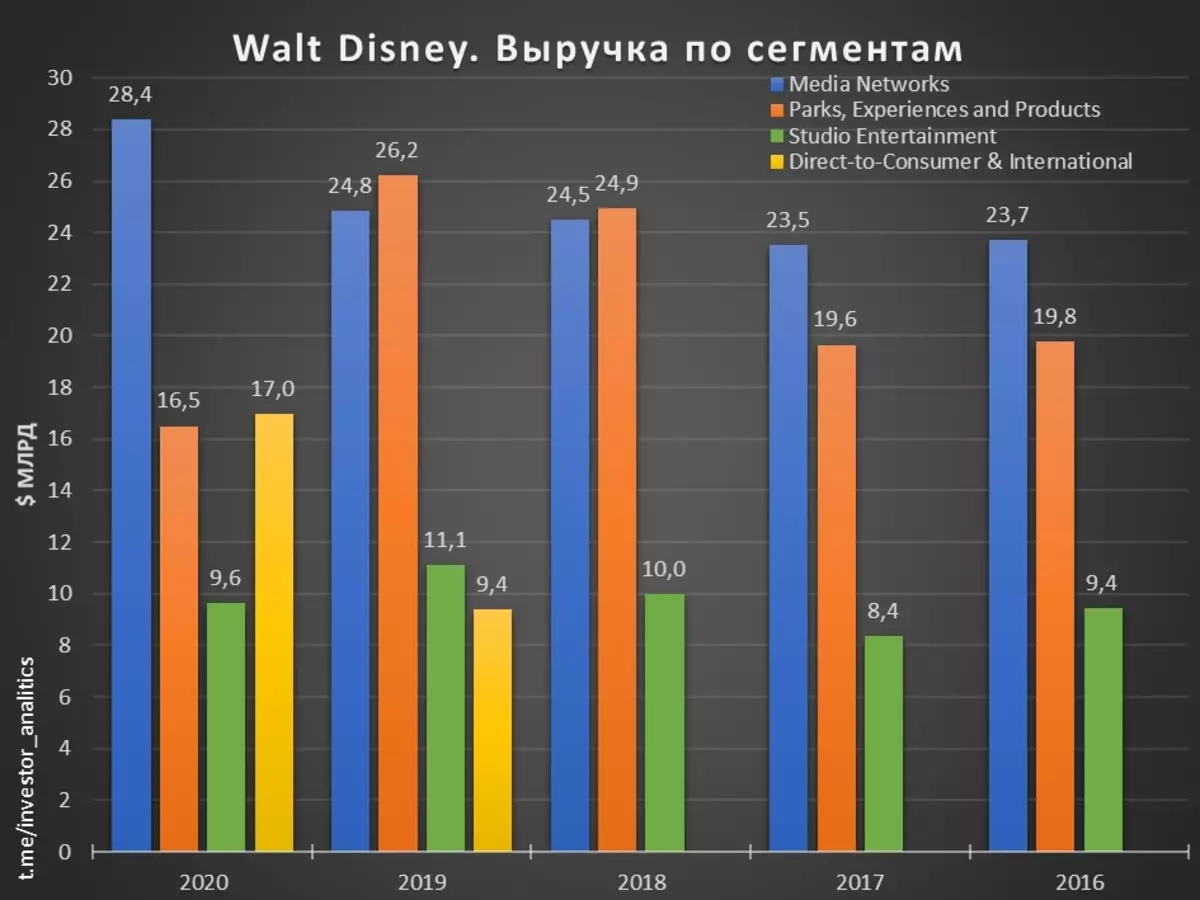

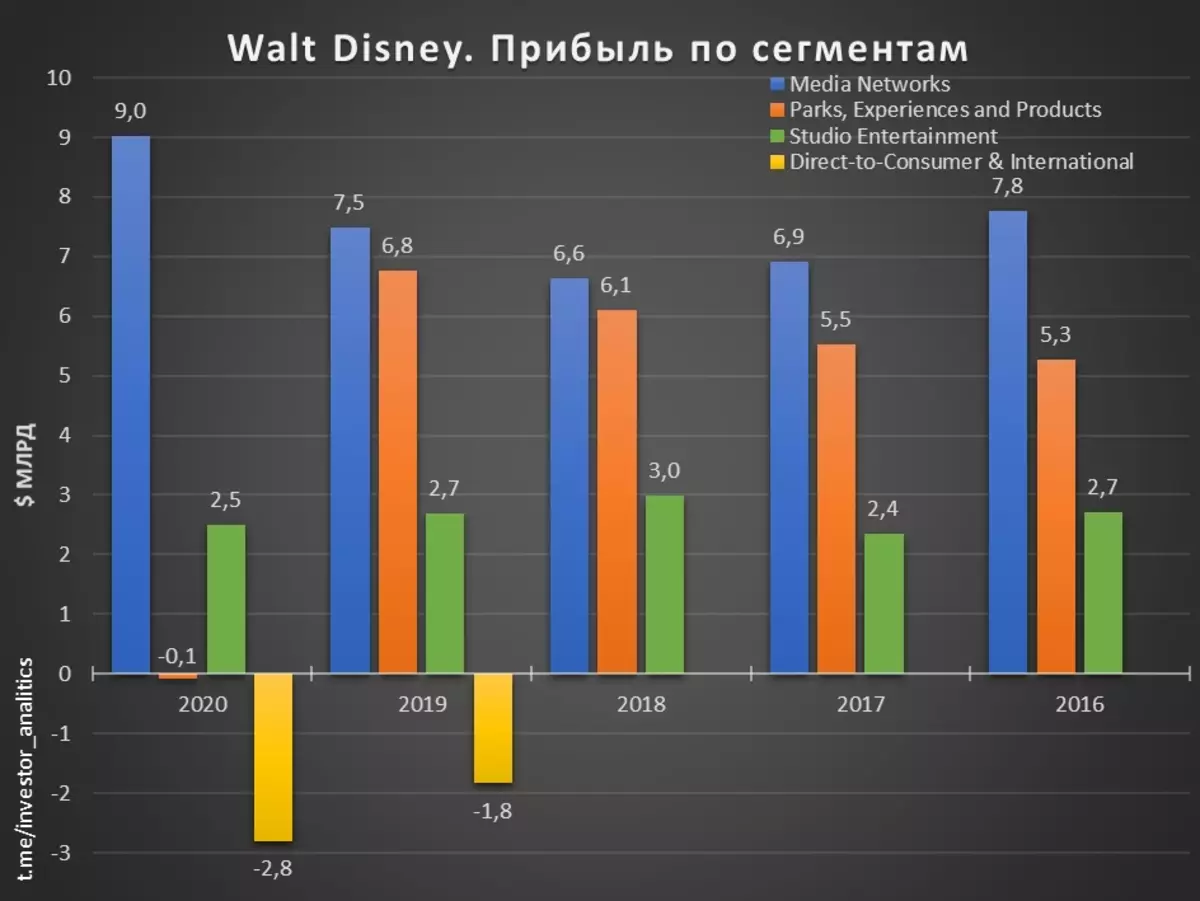

The report for the 2020 fiscal year came out on October 3, while on February 11, a report was published for the first quarter of the 2021th fiscal year. Disney allocates 4 main business segments:

- Mass Media (Media Networks) - television networks (ABC, National Geographic), television stations;

- Parks and goods (PARKS, EXPERIENCES AND PRODUCTS) - Thematic parks and resorts, cruise company, licensed goods under the brand "Disney" (toys, magazines, various attributes);

- Studio Content (Studio Entertainment) - film studios, animated studios, recording studios and theatrical productions;

- Own content sale to consumer (Direct-to-Consumer & International) - Stringing services (Disney +, Espn +, Hulu), branded international TV channels, applications, sites.

On March 20, 2019, a transaction was closed to acquire most of the company 21st Century Fox for more than $ 71 billion (and initially the amount of the transaction was negotiated in the amount of $ 52 billion, but Comcast Corporation (NASDAQ: CMCSA) joined the game, which also expressed interest in buying And she tried to kill the discney supply). As a result of the transaction, Disney assets increased almost 2 times.

A large transaction with a coronacrizis led to the growth of debt load 3 times (compared to 2018) and an increase in EV / EBITDA multipliers to 31 in 2020 (from an average of 11, which was held for many years until 2019,) and Debt / EBITDA to 11.9 in 2020 (with an average value of 1.3, which has been held until 2019). The 2020th year Disney completed at a loss of almost $ 3 billion (against profit $ 11 billion in 2019), and in the 1st quarter of the 2021th fiscal year showed minimum profits of several million (reduction of 99% year by year) that Inspired by investors, since the forecasts were much worse. Dynamics of revenue and profits in segments are presented in diagrams.

The segment of streaming services is very actively developing, but so far unprofiled, which is associated with serious investments to conquer the share of the world market. In October 2020, Disney announced the reorganization to strengthen the position of the Direct-to-Consumer segment. It is clear that the pandemic has greatly influenced Disney, and predict future financial results are quite difficult: entertainment parks in individual countries are closed, access is limited in cinemas, so the company has chosen, as it seems the right way to the intensive development of cutting services, but so far the investment is not pay off. In addition, rating agencies in 2020 reduced the Disney credit rating, which can lead to the increase in the cost of servicing a big debt and, as a result, decline in investment in business development.

Comparison with competitors

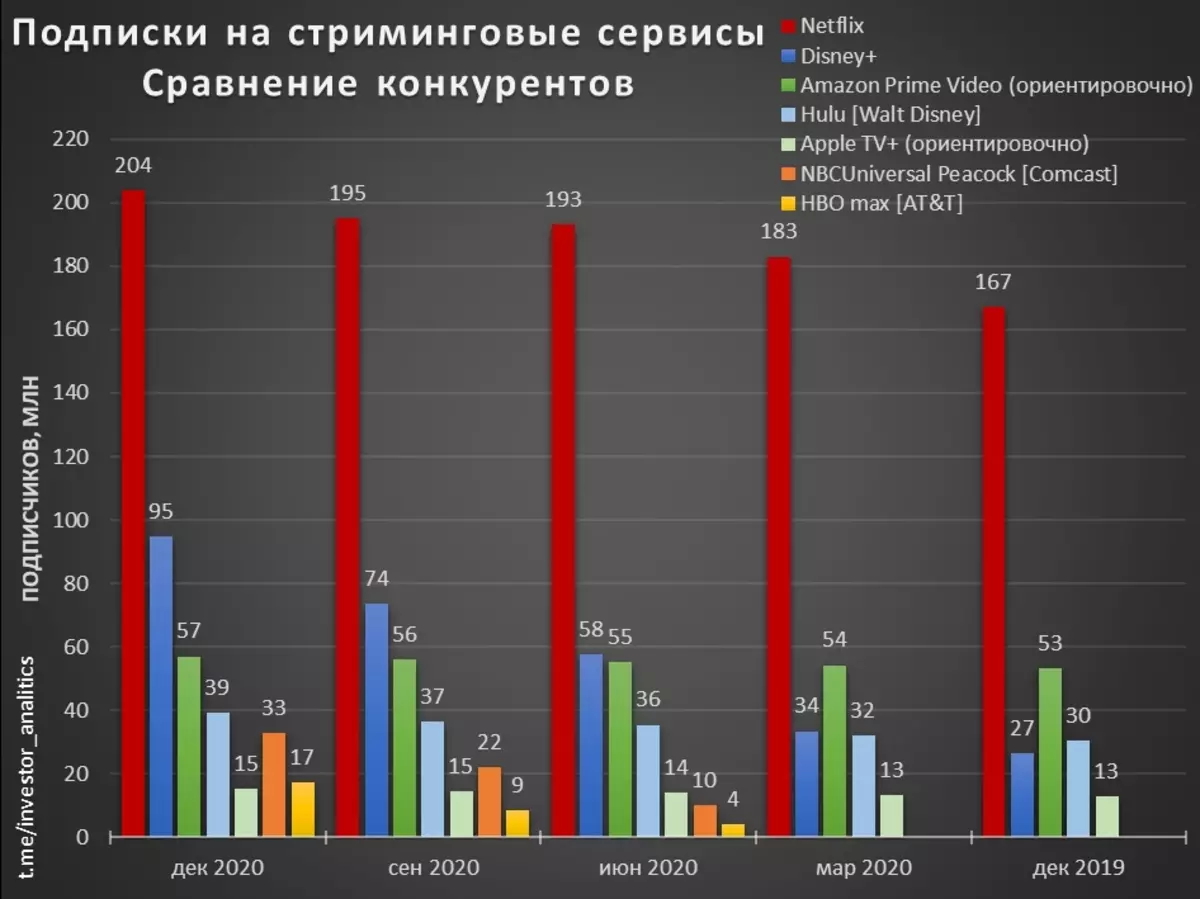

Disney is represented in different segments and in each has serious competitors, but today I will focus on the analysis of competition in the Stregnated Services. A comparison of a change in the number of paid subscribers for the 2020th year - everyone sat at home, and the streaming services had a real struggle for each viewer. Disney will consider Disney + (launched in November 2019) and Hulu. Competitors:

- NetFlix (NASDAQ: NFLX)

- Amazon (NASDAQ: AMZN) Prime Video - Evaluation Rough, subscribers are calculated - there is data on the number of subscribers to Amazon Prime, which includes many services in one subscription, and there are statistical data on the percentage of subscribers who use the Stricming Service

- Apple (NASDAQ: AAPL) TV + - launched in November 2019; Rating rough, subscribers are calculated - the annual subscription is free when buying Apple devices, according to various statistical data, precisely paid subscribers are calculated.

- NBCUniversal Peacock (from Comcast) - launched in April 2020

- HBO MAX (belongs to AT & T (NYSE: T)) - launched in May 2020

Changing subscribers is presented in the diagram.

Incredible breakthrough Disney + - 58 million for 9 months and almost 100 million subscribers 14 months! Compare NBCUniversal Peacock, who managed to get 33 million in 9 months, or HBO MAX, which only 17 million in 9 months. Disney is very correct, and most importantly - on time, made a bet on the world development of the service, while Peacock and HBO Max work in the US and are just going to enter the global market.

Technical analysis

Having pushed off from supporting $ 120, the stocks in a couple of months received an increase of + 50%. At all timeframes, starting from daytime, trend ascending, and therefore it is not technically reasons to sell, but also to buy it too late. The nearest day support is $ 183, below - significant support for $ 170 and $ 152. Resistance is indicated by $ 190. Turning down is not formed, so for now the quotes can continue to pull up trend on an indefinite height.

Possible investment plan

Current state in disney promotions I would call the classic example "buy on rumors, sell on facts." For the first time in decades, the company showed a loss for the year, she has a huge debt (which is still possible to serve), part of the divisions cannot work due to coronavirus. But there is potential - huge potential - through the purchase of 21st Century and the rapid development of Disney +. Therefore, it is impossible to buy a long-term investor now! It is necessary to wait for the very sale of facts. Objective to current financial indicators of the company's level of purchase, in my opinion, $ 120. I recommend waiting for a decline at least to support $ 152, and only then to start considering the possibility of buying on the basis of emerging news and financial results.

Read Original Articles on: Investing.com