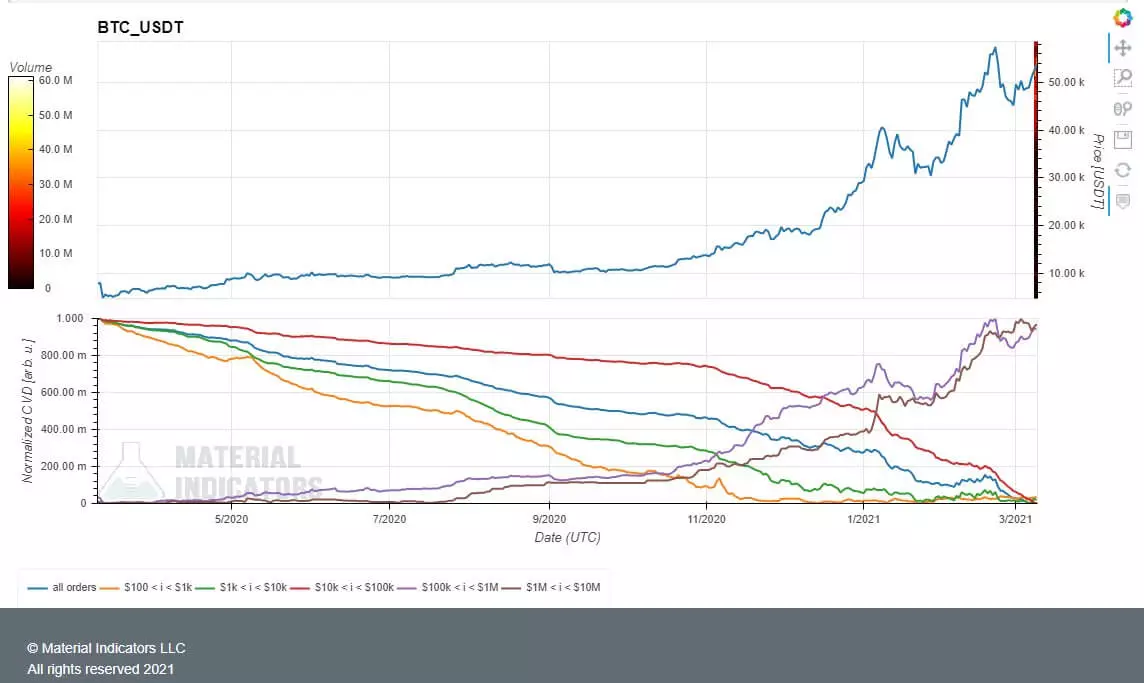

Large cryptocurrency investors did not miss the opportunity to be purchased by Bitcoin during the next collapse of the coin market. According to the Material Indicators platform, the number of orders - or applications - to buy a BTC in the amount of 100 thousand dollars and more on the Binance Exchange has grown to a historic maximum. In other words, the demand for bitcoins against the background of rolling back the main cryptocurrency is only strengthened, which indicates the continuation of the bullish trend and the calculation of investors for further growth. We tell about the situation more.

We checked the latest data: today Bitcoin started a day from 54 thousand dollars. The cryptocurrency rose per day by 0.8 percent, as a result of which its market capitalization is 1.008 trillion dollars.

It is important to note that at night BTC reached a level of 55,748 dollars, after which she asked. This level of cryptocurrency did not reach from February 23.

Graph Bitcoina for a monthWho buys Bitcoin

Large BTC purchases are now more common than ever. That is, organizations, companies and simply individual investors with large deposits are actively buying coins from the Investors of Smaller Caliber.

Recall, most often the buying coins really occurs in essence in less experienced investors and traders. The latter because of the lack of experience are often amenable to emotions on market collaps and want to keep their money that allegedly disappear. Therefore, they get rid of cryptocurrency due to fear than fixing the loss and lose money.

However, here they do not take into account several points. First, the volatility is that there are sharp changes in the cost of cryptocurrency assets - this is the usual feature of this niche, so it must be completed. That is, large projects on the type of Etherium and Bitcoin until that time not only returned to their historical maxima, but also updated them. Secondly, most often the course bounces exactly when inexperienced traders get rid of their assets. This happens due to the fact that the number of sellers eventually is exhausted, and buyers use moments and replenish their stocks. Hence the growth.

As a result, after all this, newcomers in the market sometimes open the same positions, but at a higher price. So you can lose money even during the growth stage of the industry.

Previously, the Material Indicators experts expressed concern about the growth of digital assets this week, arguing that large players can "sell" coins against the background of the last price jerk. With this scenario, the market could face the next wave of correction. As a result, this did not happen, and therefore analysts noted that macroeconomic factors had a different impact on Bitcoin than expected earlier.

In addition, the last rollback of Bitcoin coincided with the conclusion of more than 12 thousand BTC with the Coinbase Pro cryptocurrency exchange. Recall, usually the conclusion of coins signals the conclusion of a large OTC transaction with large investors, that is, some successful organization once again acquired a large batch of bitcoins, reports Cointelegraph.

Note that recently this happens quite often. Yesterday we learned that the Norwegian holding company Aker ASA created a special division to work with cryptocurrency and investments in the startup blockchain. They began his journey to the niche of advanced financial technologies, they began with acquiring 1170 bitcoins by $ 58.5 million. About the vision of the guigament management read in a separate material.

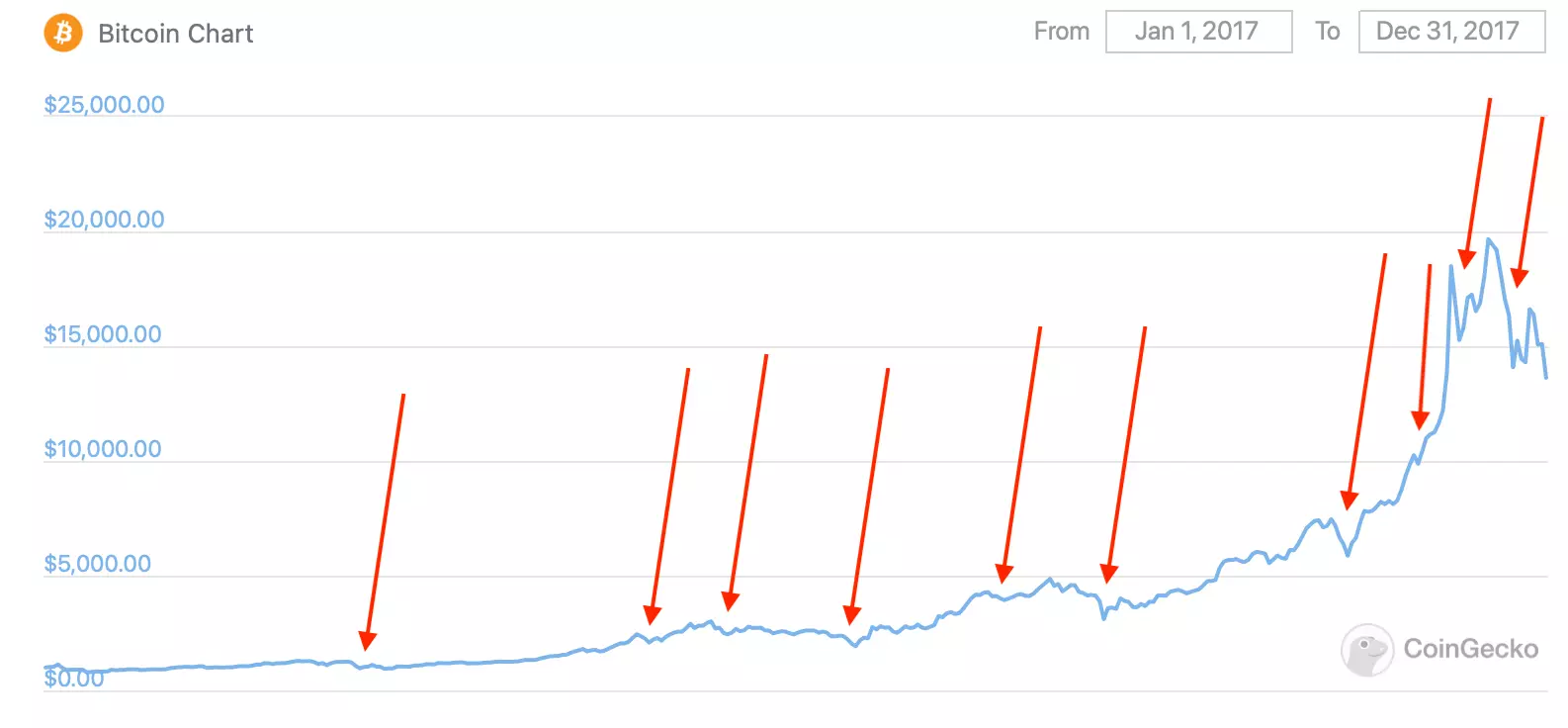

During the current collapse, Bitcoin fell about 26 percent, reaching a local bottom at 43 thousand dollars. During the previous growth stage in 2017, the main cryptocurrency rolled back at least seven times on average by 30-35 percent before reaching a maximum at the level of 20 thousand dollars.

Large scholars of the cost of BTC are noticeable on the chart.

We believe that analyst data indicate a positive on the market. Judging by the activity of traders, they do not doubt the growth of the first cryptocurrency and industry as a whole. And if most investors come to this point of view, the BTC correction period can indeed end. However, for the final confirmation of this version, Bitcoin would definitely not hurt to update the new historical maximum. He will remind, is at the level of 58,640 dollars.

What will happen to Bitcoin on? Share your opinion on this bill in our cryptocat of millionaires. There are also other important details associated with the coin industry.

Subscribe to our channel in Telegraph. Tuzumen not far off!